RECs and Carbon Offsets

This article examines and presents the differences between renewable energy credits (RECs) and carbon offsets, the methodology behind carbon emissions reduction mechanisms, building code commentary on these mechanisms, and the current, prominent certification systems.

While both renewable energy credits (RECs) and carbon offsets are tools to reduce carbon emissions associated with a building or company, they do not work the same. A carbon offset is a tradable credit representing a metric ton of CO2e emissions avoided or reduced. According to the EPA, a REC is “a market-based instrument that represents the property rights to the environmental, social, and other non-power attributes of renewable electricity generation.” Both are ‘credits’ for reducing carbon and can be bought and sold to other entities to use in their carbon emissions accounting.

Key Points

- A carbon offset is a tradable credit representing a metric ton of CO2e emission avoided or reduced and can be used for direct emissions (emissions from refrigerant leaks, on-site natural gas/propane/fuel oil usage, transportation) or indirect emissions (emissions from off-site energy usage, e.g. electricity, steam, district systems).

- Carbon offset projects feature additionality testing, which incorporates quantifiers requiring emission reduction or elimination to be “real,” “permanent,” and “verified.”

- The following are the most prominent, broad systems used internationally: Gold Standard, Climate Action Reserve (CAR), American Carbon Registry (ACR), Verified Carbon Standard (VCS), and Plan Vivo, which are all used by the Green-e Climate certification used in LEED Gold and BD+C credits.

- The ZERO code was adopted in an appendix of the International Energy Conservation Code (IECC) 2021 Report and combined carbon offsets/renewable energy options with ASHRAE 90.1 2016 code compliance and .

Introduction

Since 2022, Green Building Alliance has accepted the use of on-site and off-site renewable energy certificates (RECs) in the calculation of Pittsburgh and Erie 2030 District partners’ performance calculations. However, RECs are not the only viable strategy for allowing property partners to reduce their carbon emissions.

As a result of discussions regarding the implementation of stretch codes within the City of Pittsburgh, the 2030 District team was prompted to investigate the possibility of allowing property partners to use carbon offsets to improve their performance. Carbon offsets were previously discouraged due to a lack of formal infrastructure and verification systems but are now reaching a more standardized status after becoming more prominent within the construction sector. The use of carbon offsets as well as RECs helps properties to decrease emissions.

However, there is a difference between net-zero energy building, which is “an energy-efficient building where the actual annual delivered energy is less than or equal to the on-site renewable exported energy,” and carbon zero, which means that carbon emissions are not being produced. Carbon zero is a much more specific zero-quantification, while net zero energy includes emissions as well as energy production. Carbon offsets aid in reaching carbon zero while RECs aid in reaching net zero energy. At the end of the article, additional resources are provided for further reading purposes.

RECs vs Carbon Offsets

While it is common for the term “offset” to be used in conjunction with RECs, RECs and carbon offsets are different mechanisms. According to the EPA, a REC is “a market-based instrument that represents the property rights to the environmental, social, and other non-power attributes of renewable electricity generation.”On the other hand, the EPA states that a carbon offset is a tradable credit representing a metric ton of CO2e emissions avoided or reduced.

The first major difference between the two is the fact that RECs are only attributed to reducing carbon emissions from electricity usage, whereas carbon offsets can be used to reduce carbon emissions from any fuel or activity that would produce it, e.g., natural gas usage or the emissions produced by a company’s supply chain. RECs are measured in terms of 1 MWh of carbon-free electricity generated, while carbon offsets are measured in terms of 1 metric ton of CO2e avoided or sequestered. As a result of these units, the purpose of RECs is based on different carbon-free electricity sources, while carbon offsets are solely representing the reduction or avoidance of emissions from any source.

Next, RECs are only able to address emissions from electricity usage, while carbon offsets can address both indirect and direct greenhouse gas emissions. According to the EPA’s Green Power Partnership, this comes into play when assessing accounting guidance as RECs look at direct evaluations in terms of emissions, while carbon offsets look at net evaluations. This is due to carbon offset projects ,including reduction strategies that are implemented elsewhere by other emitters. As carbon offset projects can be either indirect or direct, there is variability in project style and type with MIT citing reforestation projects, investment in renewable energy projects and sites, community projects, and waste-to-energy projects as the four most common types.

Carbon offsets are equal in terms of quantity for each project, as a carbon offset is defined by the removal or avoidance of one metric ton of CO2e emissions. While not varying in quantity, the projects will vary in cost due to location and project size, which impacts the monetary value of the offset credit. On the other hand, RECs are categorized as either bundled or unbundled. According to the IECC 2021 report, unbundled RECs are “certificates purchased by the owner representing the environmental benefits of renewable energy generation that are sold separate from electric power,” while bundled RECs include the underlying electric power. They are then further categorized by whether they are compliance RECs, which are to meet RPS requirements, or voluntary market RECs, which are supplied in areas where the market is currently oversupplied and not required.

Next, Green-e Certified RECs have a “21-month window of eligible generation.” Conversely, carbon offsets currently have a typical lifespan of two to three years, but each verification system has their own crediting period variations along with renewable options. Additionally, there is no current set procurement factor for carbon offsets, unlike RECs. For example, VCS offers crediting periods of 7 years twice renewable, 10 years twice renewable, and 10 years fixed. Due to the “permanence” factor of carbon offsets, however, the projects themselves must permanently sequester the required carbon amount to receive a credit. An example explaining sequestration and impacts from the Offset Guide is as follows:

“For example, protecting a parcel of forest from deforestation prevents 100 tons of carbon from being released into the atmosphere (reducing emissions by 100 tons). Fifty years later, however, the parcel is burned down, emitting all the carbon. The rate of emissions in year 50 is accelerated because, without the project, the 100 tons of carbon would not have been present. Net GHG reductions over 50 years are zero because the additional emissions cancel out the prior reductions.”

To be noted, however, is that carbon offset projects, unless directly involving carbon storage, are unlikely to become “leaky” and release emissions. Thus, the issue of permanence, once established within the project design, is typically sound and unchanging, unlike the example provided. According to the Carbon Offset Guide, in terms of the voluntary carbon market, carbon offset credits can be transferred between accounts within the same offset registry. Credits can be traded multiple times between multiple buyers as a result of a direct purchase or a trade agreement until the credits are either retired or used.

Finally, the standards by which each is evaluated have significant points of differentiation. Carbon offsets, in addition to REC standards, include the requirement of additionality testing. Additionality testing, described as needing to play a “make or break” role, incorporates quantifiers requiring emission reduction or elimination to be “real,” “permanent,” and “verified.” The EPA also states that additionality testing evaluates criteria within the following categories: legal/regulatory, financial, barriers, common practice, and performance tests. Additionality testing, however, is not required for RECs.

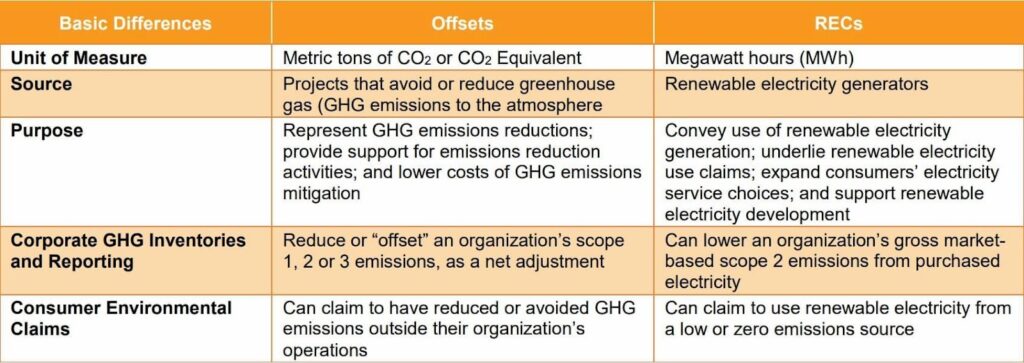

This table summarizes the key differences between using RECs and carbon offsets in a project. (Source: EPA)

Verification Systems and Methodology

When working towards verifying and registering a carbon offset project, there are several systems, each with their own methodology, to choose from. The following are the most prominent, broad systems used: Gold Standard, Climate Action Reserve (CAR), American Carbon Registry (ACR), Verified Carbon Standard (VCS), and Plan Vivo. There are additional specific-scope verification systems, but these are not used on the same scale.

These five systems all require carbon offset projects to pass additionality testing and to provide “permanent” solutions or containment for carbon. These systems are voluntary, which prevents their credits from being traded in compliance markets. In terms of value-pricing calculations for carbon offset projects, the Gold Standard identifies the following as the main categories that cause variations in value: “integrity of the standard it’s certified against, value associated with the beyond-climate sustainable development benefits, preferences for different project types or geographies and associated supply and demand dynamics, and costs required to plan, implement, and monitor a project.” According to the non-profit organization Second Nature, value-pricing falls between less than one dollar per ton of CO2e to fifty dollars per ton of CO2e- with the average range falling between three to six dollars per ton. In the additional reading section, there is a report listing the detailed transactional data, including average price, by standard.

These programs are also all used by the Green-e Certification program to verify projects based on “stringent permanence, additionality and other criteria.” The Green-e Certification is one of the most referenced resources when dealing with carbon offsets with ample public documentation on their practices and requirements, which can be found in the additional reading section. Green-e Certification certifies projects through one of the aforementioned systems while simultaneously enforcing additional requirements including annual independent audits and review by program administrators. In the United States, Green-e Certification is available for hydropower, biomass, forest conservation, and carbon capture and sequestration projects, each with their own specifications.

There was no evidence found to suggest that one of the five systems was more efficient than the others, leading to the conclusion that the choice of system would be situational based on desired requirements and outcomes. However, the Ecosystem Marketplace reported that VCS certified approximately 58% of the global offsets in 2016, with Gold Standard certifying 17%, CAR certifying 8%, and ACR certifying 3%. Additionally, the standard type plays a large role, with the full-fledged being the most stringent, as it requires accounting standards, monitoring, verification and certification standards, and registration enforcement systems. Finally, the United Nations Clean Development Mechanism (CDM) was not included in this outline, as it is used in developing countries specifically, but the criterion is used in baselines, so their documentation is included in the additional reading section.

Below are the highlights of each system’s criterion, with the full manuals included in the additional resource section for further evaluation (WWF and Green-e Certification). Each of these systems has unique methodologies that can be developed based on each specific project presented, thus making it difficult to calculate an appropriate carbon offset project amount. However, most systems look at carbon footprint calculations as a preliminary starting point for the project.

Gold Standard

- Coverage: International

- Label for Credits: Verified Emission Reduction

- Standard Type: Full-fledged

- Baseline Requirement: CDM approved methodologies

- Accepted Project Types: Renewable Energy and end-use efficiency

- Must reduce one of the following greenhouse gases: NOx, CO2, or CH4

Verra VCS

- Coverage: International

- Label for Credits: Verified Carbon Unit

- Standard Type: Full-fledged

- Baseline Requirement: VCS program-approved methodologies (includes CDM)

- Accepted Project Types: Any except GHG-producing projects

- Provides rules and requirements that must be followed by any offset program

Plan Vivo

- Coverage: International

- Label for Credits: Plan Vivo Certificate

- Standard Type: Bio-Sequestration

- Baseline Requirement: project-specific, reviewed by Plan Vivo Foundation individually

- Accepted Project Types: LULUCF except commercial forestry

Climate Action Reserve

- Coverage: United States, Mexico

- Label for Credits: Climate Reserve Tonne

- Baseline Requirement: based on benchmarks from other projects within the sector

- Accepted Project Types: projects following protocols developed by the Reserve’s board

American Carbon Registry

- Coverage: United States, some international

- Label for Credits: Emission Reduction Tonne

- Baseline Requirement: project specific

- Accepted Project Types: projects following ACR standardized criteria

Full-fledged Verification Systems

The full-fledged standard type is characterized as a verification system that provides (1) accounting standards, (2) monitoring, verification, and certification standards, and (3) registration enforcement systems. Two of the five well-accepted verification systems have been designated as the full-fledged standard type: Gold Standard and Verra VCS. Below is a detailed account of the specific aspects of both systems, provided for further evaluation of applicability and implementation. All information is taken from the Global Carbon Project report found in the additional resource section.

Gold Standard

Project Eligibility

- GS accepts renewable energy, including methane-to-energy and energy efficiency projects.

- GS excludes hydro projects with greater than 15MW capacity.

- A project cannot be in countries with an emissions cap.

- Project sizes: micro-scale (<5,000 tons CO2 per year), small-scale (5,000-60,000 tons CO2 per year), large-scale (>60,000 tons CO2 per year)

- Crediting period option(s): one 10-year period, 7-year period (renewable up to three times)

- VERs will “only be issued after the project is successfully registered as a GS CDM project.”

- GS VER projects “must show clear sustainable development benefits, including local and global environmental, social, and economic as well as technological sustainability.”

- GS requires two public consultation rounds (except at micro-scale which only requires one) and does not require international stake holder consultation.

Additionality

- These tools are project-based and require previous announcement checks.

- GS requires “application of the latest UNFCCC additionality tool.”

- VER projects can choose to use baseline methodologies approved by one of the following: Methodology Panel of CDM Executive Board, Small Scale Working Group or United Nations Development Programme MDG Carbon Facility.

- Projects can propose new methodologies that will be reviewed and approved by the Gold Standard Technical Advisory Committee for an additional price.

Validation & Registration

- Requirements for GS VER and CER projects are identical, except for a broader scope of eligible host countries and baseline methodologies.

- All projects must be “validated and verified by a DOE.”

- Key requirements: stakeholder consultation report, finished PDD with baseline and monitoring methodology, a sustainable development matrix, and a validation report.

Monitoring, Verification, & Certification

- Monitoring reports, submitted to a DOE, must be submitted yearly.

- Key requirements: verification report of compliance

- A verification report includes sustainable development indicators, which must be monitored based on whether they are “crucial for the overall positive impact on sustainable development, particularly sensitive to changes, or stakeholder concerns have been raised.

Registries

- APX, Inc., created and manages the GS Registry for Verified Emissions Reductions (VERs).

- GS does not “engage in project or credit transactions.”